Since we moved to The Woodlands in 2001, we’ve always known that we’re close to home when we could see the Anadarko tower (now towers) from the highway. With the bidding war now over - and with Chevron about to walk away with $1B as a breakup penalty - all kinds of rumors and speculation are out on the grapevine trying to guess to find out what will happen to these iconic buildings.

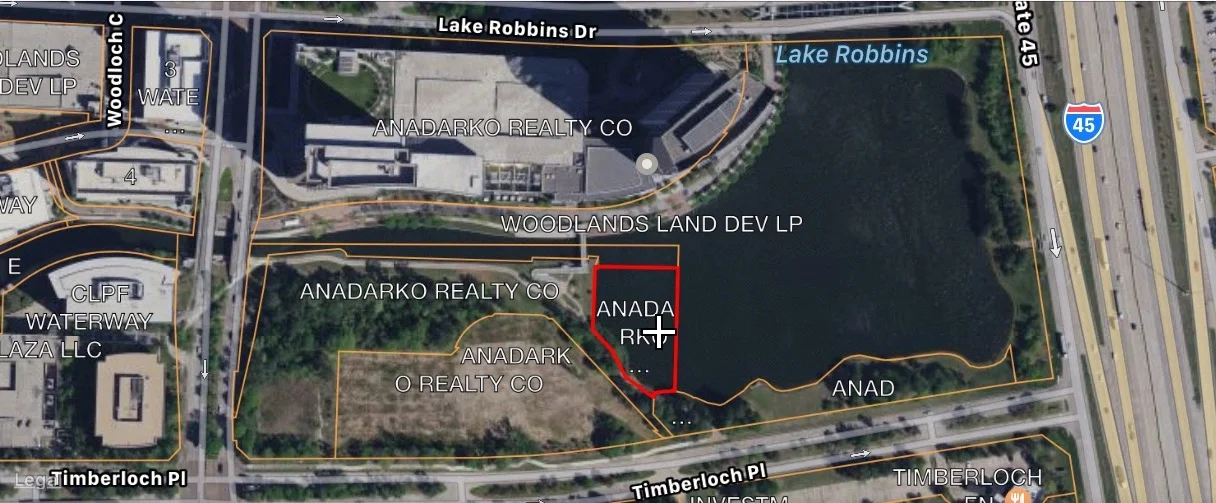

In contrast to other oil giants, Anadarko owns the real estate it sits on. It purchased about 15 acres from The Woodlands Dev Company in 1999 (Montgomery County Clerk’s office), and it has followed the expansion plan outlined in the special warranty deed: Phase I is the first tower, with 800K rentable square feet, Phase II is the second, with 400K. The deed also outlines Anadarko’s responsibilities post sale - the nature preservation corridor, its easements for pipeline and walkways, but more importantly (at least for the effect of this post), the right of first refusal obligation to the Dev Company if it wants to sell the property.

For the sake of context, Right of First Refusal is where a Seller is obligated to present an offer made by a qualified Buyer to another Party (most frequently a tenant or the party that previously owned the property), to give them the opportunity to match the offer. Unlike other countries, this right is not automatic and is typically negotiated, agreed to and documented in a recorded document.

In the case of the Woodlands Development Co, this right appears to have expired 15 years from the date it closed on the property. However, it doesn’t mean that they aren’t able to buy it. HHC Balance Sheet. Arguably, the towers are located in a more prominent spot than the (former) CB&I building, which Howard Hughes recently bought for about $50MM. Coupled with the sheer amount of rentable square feet (around 1.2MM), the buildings are likely to be valued in the many hundreds of millions.

So, what could happen? The big question is whether Anadarko/OXY would continue operating from here. That should sort out the choices of what would happen with the building.

Sale and leaseback - We explained above that large companies typically don’t own the buildings they’re in. HP’s campus was recently acquired by a joint venture formed by Kuwaiti and American investment firms, and XOM’s campus is last deeded to Palmetto Transoceanic LLC - although one of the principals is linked to XOM itself. Key here is if OXY is willing to essentially pay back the building (over time in rent) for a nice paycheck upfront.

Sale and move - This would depend on where does OXY/APC plan to move their employees to - existing campus, new campus elsewhere… We’ve heard those rumors before over at Grand Central Park.

Just go dark - Perhaps the least likely - who wants to pay $5M in property taxes alone every year?

Nothing. Always a choice. Maybe the towers are the new campus!

Word of caution - Note that we’re not lawyers nor we claim to be - deed documents (and particularly the ones referenced in this post) are relatively complicated and it is likely that we might miss the intention of the document, clause, etc.

What do you think it will happen? Leave us your comments below.